At the start of every bull run, we hear the same one-liner repeated:

“This time it’s different.”

Nothing is a sure thing in financial markets, and crypto brings an additional element of surprise, but I can’t help thinking that something fundamental has changed. Do I think this will bring us into an extended, so-called, “supercycle”? No. I believe, like most asset classes, crypto will maintain its cyclical patterns. I also believe that this cycle is going to be dramatically different to the last few.

Maybe it’s more, “Same same, but different.”

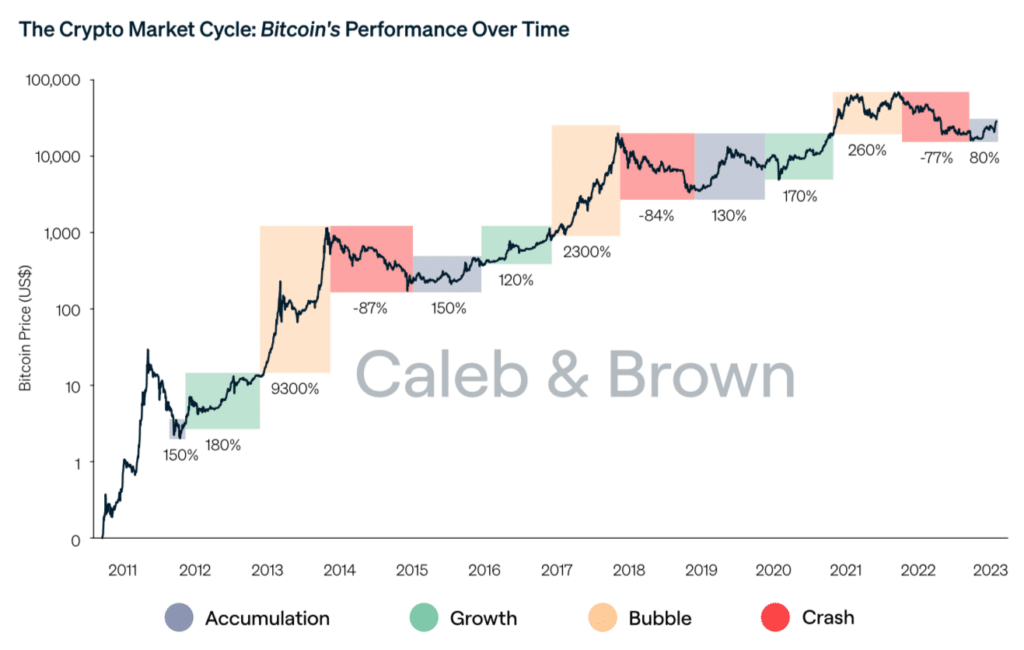

Image source: Caleb & Brown

Investing in Bitcoin isn’t for the faint-hearted. I know this from experience.

In each major cycle, Bitcoin’s price has both appreciated by at least 260% and depreciated by at least 77%. That’s quite the ride.

Bitcoin often leads the rally as well as the decline, with the rest of the market largely following suit. If you look at Bitcoin’s price chart, you’ll notice that each cycle tends to occur in four-year increments. This maps to the Bitcoin halving events where the new supply of Bitcoins entering circulation is halved.

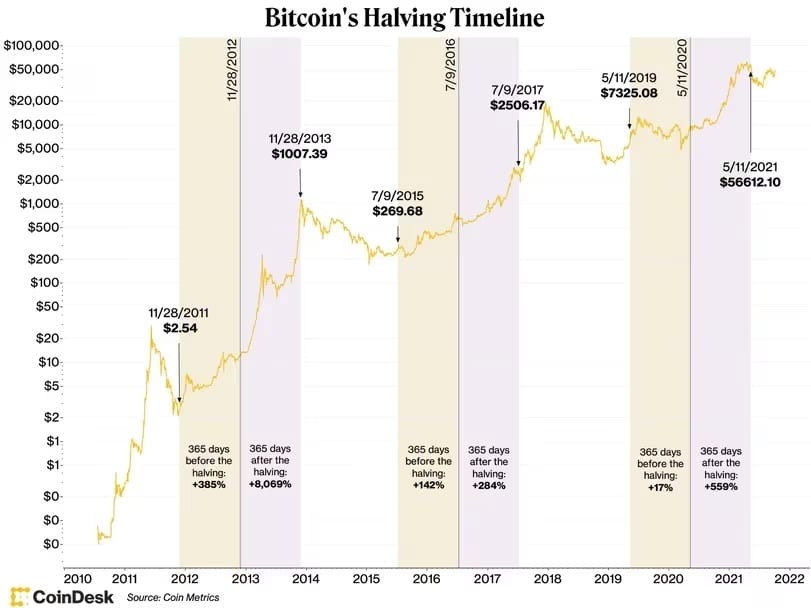

Image source: Coin Desk

It’s quite remarkable to look at Bitcoin’s price one year before and after each of the previous halving events. These have shown to be the periods where the greatest price appreciation takes place.

While history doesn’t often repeat itself, it often rhymes. I don’t know of a better chart to illustrate this in action. This is one of the reasons why there’s such excitement in the crypto space right now – we’re only a couple of months away from the next halving and history is certainly rhyming again.

It’s not just Bitcoin that follows these patterns. Bitcoin has historically created a rising tide that’s lifted the wider ecosystem of digital assets, catalyzing capital inflows that then flood across the rest of the space. 2017 was the first time this happened at scale, giving birth to the “altcoin” market, led by Ethereum and fueled by Initial Coin Offerings. The 2020 cycle saw Ethereum take center stage, with the layer-2 scaling solutions creating an explosion of innovation while yield farming and the NFT boom supercharged speculation.

Alongside all of the catalysts for the crypto market’s cyclical ascent, there were plenty that triggered its decline. In 2014, it was the Mt.Gox bankruptcy(1). In 2018, there was a regulatory backlash on ICOs(2) and the China crypto ban(3). Then, more recently, in 2022 we had the Luna crash(4) and the FTX implosion(5).

Why It’s Different

One often-neglected fact from the past three crypto cycles is that while Bitcoin’s price has followed a similar trend of huge price appreciation followed by an equally huge depreciation, the relative growth and decline have lessened.

While it might not feel like it when you view price in absolute terms, the swings during each cycle are getting less extreme. I believe this cycle will be a continuation of that trend. This would be very positive for digital assets as a whole and will build greater investor confidence in the asset class.

Speaking of investor confidence, one event that’s taken place already this year has brought structural changes to the flow of capital in crypto and further legitimized Bitcoin as a store of wealth asset: the Bitcoin spot ETF.

In the first 26 days of trading, there have been over $4.5 billion of net inflows across the ten Bitcoin spot ETFs. By any measure, the Bitcoin spot ETFs have been a blockbuster success. Blackrock’s $IBIT ETF alone has breached the top five ETFs by inflows for the past week(6). The “money sitting on the sidelines” has been talked about for years in crypto, and now we’re seeing the impact of when institutional investors have easy access to Bitcoin exposure, and this is just the beginning. Access to the ETFs still isn’t widespread, with some high-profile brokers not listing it(7), and many banks beginning to petition the SEC for changes to the costs of holding digital assets as they chase a slice of the pie(8). Then there’s the appetizing prospect of trading options on the spot ETFs.

All of the above comes in the background of a significantly rosier macroeconomic outlook. We’ve just come through a historic period of high inflation, which most market analysts agree has reached its peak(9). Attention now shifts to when the Federal Reserve and other major central banks will begin lowering interest rates, with many investors betting on this happening around May 2024.

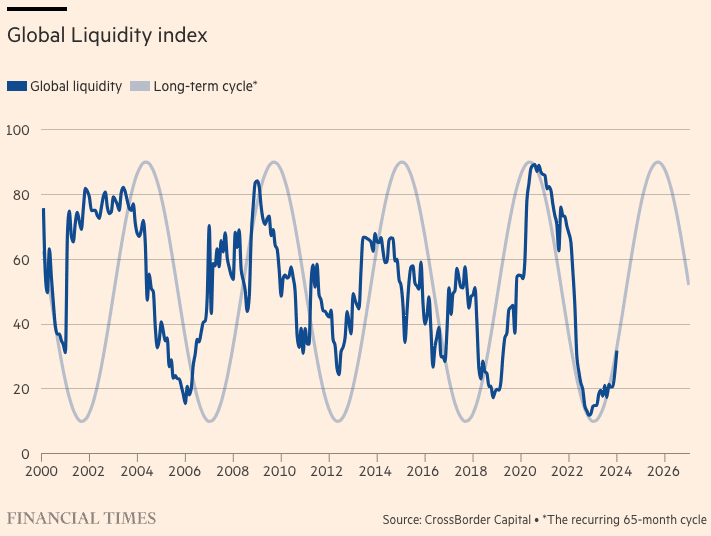

Image source: Financial Times

Once this happens, liquidity will enter the broader market and this will spill over into crypto markets. The cost of capital is set to come down dramatically over the next 24 months, which will likely fuel a new wave of institutional capital investments. The 2024 US elections will only amplify this as the impetus shifts from stemming inflation to driving economic growth.

All this to say: there have been significant structural shifts in crypto markets and the macroeconomic outlook ahead is extremely positive.

This Cycle’s Catalysts

Zooming further into the innovation happening in the crypto space, there’s a lot to be excited about. The wider economic environment has given breathing space for the latest cohort of projects to thrive and we’re beginning to see the early signs of what’s to come.

Like in 2020, there’s plenty of attention being placed on blockchain scalability. The imminent rollout of Ethereum’s Dencun upgrade will see the introduction of proto-danksharding(10), which will dramatically reduce the cost incurred by L2 rollups posting transactions to Ethereum. This will spur a renewed wave of interest (and speculation) into the L2 ecosystem. At the same time, protocols focused on parallelization and modularization have been garnering a lot of attention and are likely to be some of the big winners in this cycle.

Image source: Kraken

Sei and Celestia are protocols focused on this area and they’ve already seen their native tokens rise by more than 600% and 185% respectively.

On top of this, the much-anticipated decision on the Ethereum spot ETF approval comes in mid-May. If we get the green light here, you can expect green candles to follow.

Another exciting development is restaking. The upcoming launch of EigenLayer is set to be one of the largest airdrops in crypto history, and the underlying technology that it brings with it will usher in vast improvements to scalability. EigenLayer’s points program alone has helped it capture over $6bn of TVL in just a few months.

If that wasn’t enough, Bitcoin DeFi is also starting to take shape. The meteoric rise of Ordinals last year has paved the way for an expansion of Bitcoin’s use cases, with several Bitcoin layer 2 networks gearing up for launch. This, combined with the halving in April is paving the way for more capital to flow into Bitcoin and its surrounding ecosystem.

And finally, at a more foundational level, blockchain technology has matured to a level where it’s far more resilient than in previous cycles. Those that lived through the previous bear markets and weathered the storms they brought have only got stronger. Lessons have been learned, and while there will still be huge hurdles to overcome when it comes to adoption, there’s momentum that’s building. Several sovereign states have adopted Bitcoin, and there’s been a sustained level of growth in payments via digital assets. In the background to all of this, and despite the current environment in the US, many regulators around the world are providing clarity on their stance surrounding digital assets. While not perfect, MiCA(11) is set to arrive in the EU in late 2024 and many other equivalent frameworks will appear around the world in the coming 18 months. This at least creates more certainty for companies operating in the space.

The combination of greater liquidity, more regulatory certainty, stronger foundations, and a positive macroeconomic setting means that crypto has all the ingredients needed to have its best cycle yet.Maybe, just maybe, this time could be different.