Loyalty programs have been around as early as the 19th century(1), evolving from simple token redemptions in stores to the more complex, multi-tiered point systems we use today with credit cards and airlines. Traditionally used as a tool to drive loyalty and repeat purchases from customers, they’ve taken on a new use case over the past couple of years in the crypto space: bootstrapping user growth.

The recent explosion of points programs in crypto has reached a fever pitch. Mercenary capital travels from one protocol to another in search of yet another token airdrop, with countless individuals sharing their “free money” daily success stories online – further fueling the feeding frenzy. But is this delivering long-term value for the majority of the protocols running these programs?

My take: absolutely not. In fact, I’d go as far as to say that this is actively damaging their growth prospects. As tempting as it sounds, you’ll never buy your way to product-market fit. At some point, the bubble will burst, and the higher you climb, the harder you’ll fall.

I’ve spent several years focused on growth in the crypto space, both on the protocol side and now at a centralized exchange. Solving the cold start problem of user growth is very challenging, and driving long-term customer loyalty is even more difficult. Despite my opinion that the majority of the current wave of points programs are detrimental to growth, I do see an important role for them in crypto which I’ll explore in this short essay.

The Blur Effect

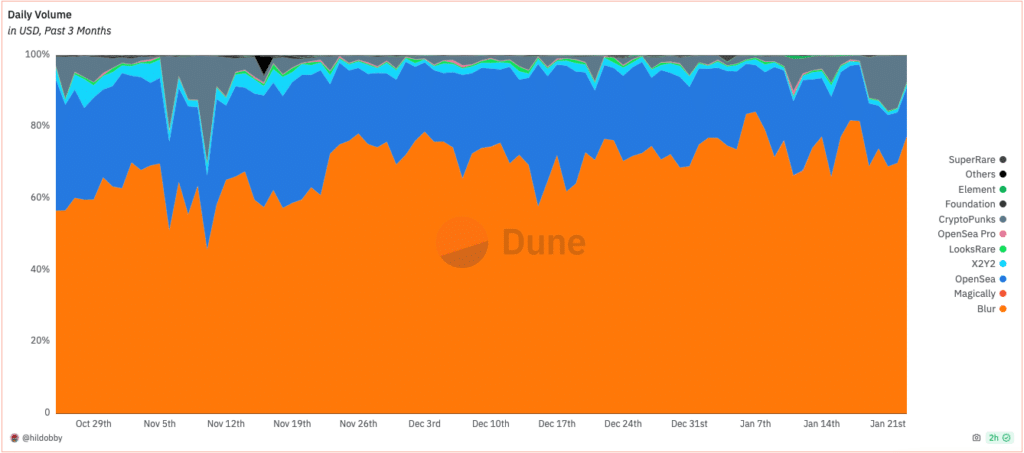

Blur, the leading NFT marketplace(2), arrived out of nowhere in what seemed like an industry that had already chosen its winner: OpenSea. Within just a few months they went from being unheard of to being the market leader by pretty much every measure. In the past 3 months, they’ve accounted for >75% of total NFT trading volume and that number only seems to be growing.

The catalyst for their meteoric rise wasn’t related to the superiority of their product. In fact, at a certain level, NFT marketplaces have become somewhat undifferentiated and arguably commoditized. There’s no real reason why you wouldn’t jump from one platform to another outside of the fees being charged, which is inevitably a race to the bottom. Blur does have lower fees than OpenSea, but so do many other competitors yet they’ve struggled to gain traction regardless.

The reason for Blur’s success is its points program.

Users on Blur accrue points in a few different ways, including listing NFTs close to the floor price, making trades, only listing via Blur and no other marketplaces, and more recently, lending. The more points you accrue, the higher you climb on the public leaderboard. At the end of each points season, which usually lasts several months, users are airdropped $BLUR tokens in amounts proportional to their standing in the leaderboard.

Season one ended in February 2023 and resulted in one of the single largest airdrop in crypto history, with the average airdrop being worth just under $3,000. It doesn’t take a genius to understand that people love free money, and it’s hard to think that Blur can sustain these airdrops indefinitely, but in a space where the products aren’t overly differentiated and many users simply retain in a platform due to the ongoing familiarity to it, this has proven over an extended period to be a successful strategy.

What’s important to note is that the Blur product clearly has achieved product-market fit, which means they’re in a much better position to drive long-term revenue regardless of the existence of a points program. Interestingly, Blur has nearly 10 times fewer users than OpenSea despite doing around 6 times their volume. While the initial outcome of their points program was that it drove in a ton of new users, since then it’s shifted more to driving up the lifetime value of their existing customer base.

Missing the Point

Off the back of Blur’s rise, we’ve seen an explosion of protocols across several verticals trying to replicate their success. Many of these have failed and paid the ultimate price.

Even before points were the industry meta, protocols have been using incentives to try and rapidly grow their user base. The Defi Summer of 2020 was a perfect example of this where we were introduced to the concept of yield farming. This largely proliferated in decentralized exchanges where they needed to source liquidity for their different token markets. To solve this problem they offered incentives to liquidity providers, usually by printing more of their native token. The result was that they had huge inflows of liquidity as people rushed to farm the token incentives. When the incentives dried up or more attractive ones were offered elsewhere, the liquidity providers simply removed their capital and deposited it on another protocol. This was very problematic because not only did the protocol lose the majority of its liquidity needed to function, but it also massively devalued its native token (through intense sell pressure as farmers sold them), leaving them stuck with fewer routes to raising capital.

The worst part about this situation is that it rarely actually resulted in more users coming to the protocol. Sure, they brought in a ton of liquidity but did they generate even remotely enough in fees to balance the cost of incentives paid out? Of course not. This is a classic example of trying to introduce incentives at the wrong time: that time being pre-product market fit.

In an attempt to combat the issues outlined above, the next wave of protocols looking to become a category leader tried a variation of the yield farming approach. They offered incentives to liquidity providers while offering the potential of an airdrop to users who used their protocol. This, in theory, would balance both supply and demand, creating revenue in the process. Yet again, the problem arose that once these incentives dried up, their users realized that they didn’t want to use the product because they had no clear need for it. And so, history repeated itself.

One of the few protocols of this era in DeFi that managed to successfully execute an incentive program that drove both new users and retention was Uniswap. Their infamous $UNI token airdrop totalled $3.4bn in value and was distributed across more than 250,000 wallets(3). Fast-forward nearly four years to today and Uniswap is by far and away the market leader in DEX volume, rivaling many major centralized exchanges(4). Why did they succeed while others perished? Uniswap was a first-mover and category creator. They built a truly innovative product that solved an enormous need, quickly establishing product-market fit. Even when rivals like SushiSwap attempted to absorb Uniswap users through even larger incentives(5), Uniswap’s dominance remained.

These Aren’t Your Customers

For any new business, overcoming the cold start problem is no mean feat. Getting early data on your customers helps to inform your future product roadmap and, when done correctly, should drive ongoing user growth and retention.

user behavior, under a points program, morphs to respond to incentives.

Li Jin, cofounder of Variant Fund

If you’re using incentives to bring these early users in, you’re unlikely to gather accurate insights about their behavior. As Li Jin, cofounder of Variant Fund, puts it(6), “user behavior, under a points program, morphs to respond to incentives.”

I experienced this first-hand during my time at Decentral Games, a web3 game studio. We benefited from the capital explosion that game with the play-to-earn craze(7) and we brought in a ton of early users from our early NFT sales. While the numbers looked great on paper, we quickly realized that the users we’d acquired into our ecosystem were not the target audience for our product. A large majority of them were simply speculating on the value of our in-game assets vs being gamers looking to consistently play our games. We’d bootstrapped user growth but it came at a cost.

Most of the 2020/21 cohort of web3 games faced the same problem. Axie Infinity was the poster child of web3 gaming and their incentive program was heralded as a form of universal basic income at one point(8). They reached unprecedented levels of user growth for a web3 game, generating over 5 million MAUs at their peak. What quickly became apparent was that many of these “users” were bots(9) or click farm operations interacting in a completely inorganic way to maximise their incentive accrual.

Doing it Right

We’ve reached the stage where whole secondary markets have opened up to trade points from various protocols on the promise of unquantified future token airdrops. As an example, points from the much-hyped EigenLayer protocol are currently trading for around $0.11 per point, while the once-flavor-of-the-month, FriendTech has in some cases traded for upwards of $44 per point.

What’s the math on calculating these points’ value? Who knows, but it both validates that there’s a huge appetite for point systems and illustrates that the obfuscation of their true economic value only adds to the allure. In fact, this obfuscation may be particularly important when it comes to staying on the right side of the regulators(10).

Cutting through the hype, how can protocols looking to support their growth tap into a points program in a way that delivers positive long-term outcomes? Well, the first and most obvious requirement from what I’ve mentioned so far is that you shouldn’t be introducing an incentive system like this until you’ve achieved product-market fit – or if you’re a first mover – this shouldn’t be the vehicle through which you determine product-market fit.

The focus should be on lifetime-value expansion, likely driven by i) improved retention, and ii) product cross-selling. This involves doubling down on your existing customer base, and with that, your incentives mustn’t cannibalize your existing revenue. By this, I mean that you should avoid offering monetary incentives for actions that a user would have taken anyway. Fee discounting is a prime example of this. For example, let’s say you offer a fee-free trade after a customer has placed ten trades. The discount probably isn’t that meaningful enough to your customers to incentivise them to place ten trades when they otherwise wouldn’t have, so you’re effectively offering a discount to users who would’ve already taken this action without an incentive in place. A better way to approach this would be to offer a fee-free trade on a product they haven’t used before – for example, a futures perp trade. This might be enough to encourage them to use a new feature, which could lead to them using it again, creating new revenue and expanding their LTV.

Increasing the cost of moving from your protocol to a competitor is another great way to drive retention. The airline industry has been doing this for decades with air miles loyalty programs. The more you fly with your chosen airline, the higher up the reward tiers you go and the more benefits you unlock. Even when there are cheaper flights elsewhere, many consumers will stick with their airline of choice because the perceived opportunity cost of not accruing air miles is higher than the increased cost of airfare.

As I mentioned previously, Blur implemented their “Listing Loyalty” feature within their points program that incentivized their users to exclusively list NFTs on their platform vs their competitors. If they did this, they got an additional multiplier on their overall points. If they didn’t, they were penalized. What’s brilliant about this is that it promotes user retention while avoiding incentivizing inorganic behavior.

I have plenty of examples that I can point to where I’ve observed protocols trying to achieve a similar outcome but going about it completely the wrong way. One example from the past few months is Orbiter Finance. Orbiter is a cross-chain bridge and a major part of their points program focuses on users accruing points by bridging from as many different chains as many times as possible.

In theory, this sounds good, but in practicality, you’re just incentivizing users to carry out mindless, inorganic behavior for the sole purpose of farming potential rewards. I’m not convinced that bridging minuscule amounts of ETH back and forth between the Manta L2 and Ethereum L1 is going to build long-term habits and loyalty. As soon as the points dry up, all of this activity will stop. I don’t mean that they won’t retain any users but they’re certainly not going to be acting in the same way.

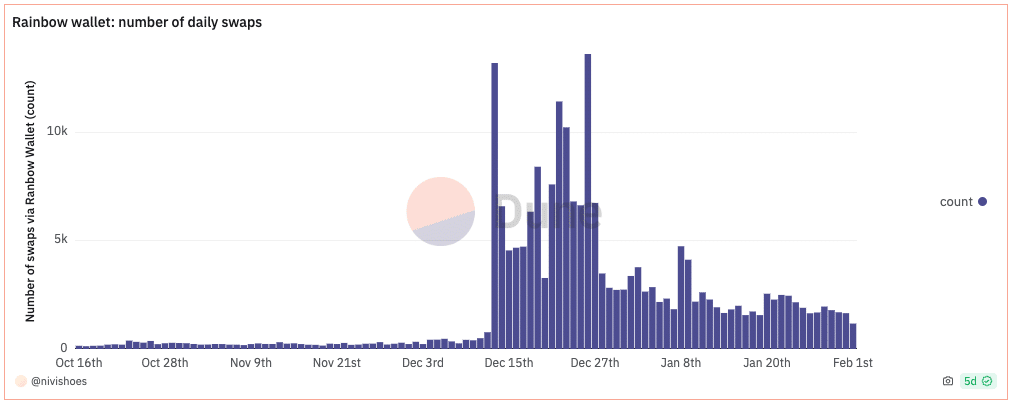

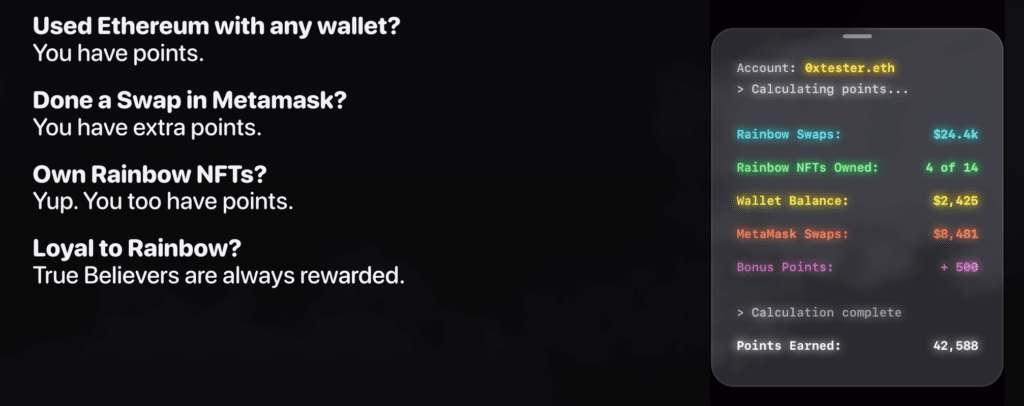

Cross-chain bridges are an example of an application that has become somewhat commodified in crypto. Past a certain level of speed and security, they’ve become undifferentiated. This is the same in many ways for wallets, and to a certain degree, DEXs. For those building products in these spaces, this is actually where a points program can be deployed to good effect. Rainbow Wallet’s current loyalty program has already done a great job of pulling users away from MetaMask, the industry-leading wallet. There was a lot I liked about how they structured their points program but two things stood out to me:

- They gave out points to anyone who had used MetaMask’s (their competitor) native swap feature.

- They offer ongoing points for the usage of different features within Rainbow Wallet.

On the first point, this is a classic vampire attack with a twist. They’re ultimately rewarding users who are the best possible fit for being high LTV users of their product. The Rainbow team created a whole onboarding flow to simply import your MetaMask accounts into Rainbow to minimise friction. Then, the second part of the program comes into play: they incentivise these high-value users to try out all of the features of their wallet to illustrate that the experience is either on par or better than that of their competitor.

What’s key is that Rainbow has the right to win in the crypto wallet market but their biggest barrier was a user’s willingness to migrate. This solves that problem.

Peak Points

Will points be another fad in crypto? Probably. Is there a place long-term for them? Most likely. Will a small few make a ton of money through them regardless? Absolutely.

If you’re a team building what you believe can be major playing within your niche in crypto, I’d encourage you to avoid the distraction of the current feeding frenzy. Instead, focus on building products that solve a real problem in a delightful way. Once you’ve done this and possess the right to win, by all means, explore how an incentive program could drive greater ARPU and stickier retention – your future self (and users) will thank you.

Just remember, share the wrong carrot with your customers and it’s your growth that will receive the stick.