Ordinals, an innovative and divisive new project has brought NFTs to Bitcoin.

Coined as “Digital Artifacts” by Ordinals founder, Casey Rodarmor, the NFTs have been the topic of much debate. On one side, there’s the argument that Bitcoin should be exclusively used for financial transactions, with anything outside of this being a deviation from its mission. On the other side, Ordinals is paving the way for new use cases on Bitcoin that can both drive additional revenue for miners and increased interest from end users.

Whatever your stance, it’s clear that Ordinals has brought renewed interest in the Bitcoin blockchain. And with some of these early NFTs being sold for over 1 bitcoin (~$23,000) it’s been capturing the imagination of speculators.

What is Ordinals?

Launched only a few weeks ago, Ordinals has pioneered a way for NFTs, referred to as “Digital Artifacts”, to be created on Bitcoin. This has been made possible since Bitcoin’s Taproot upgrade (November 2021), as well as the Segwit upgrade from back in 2017.

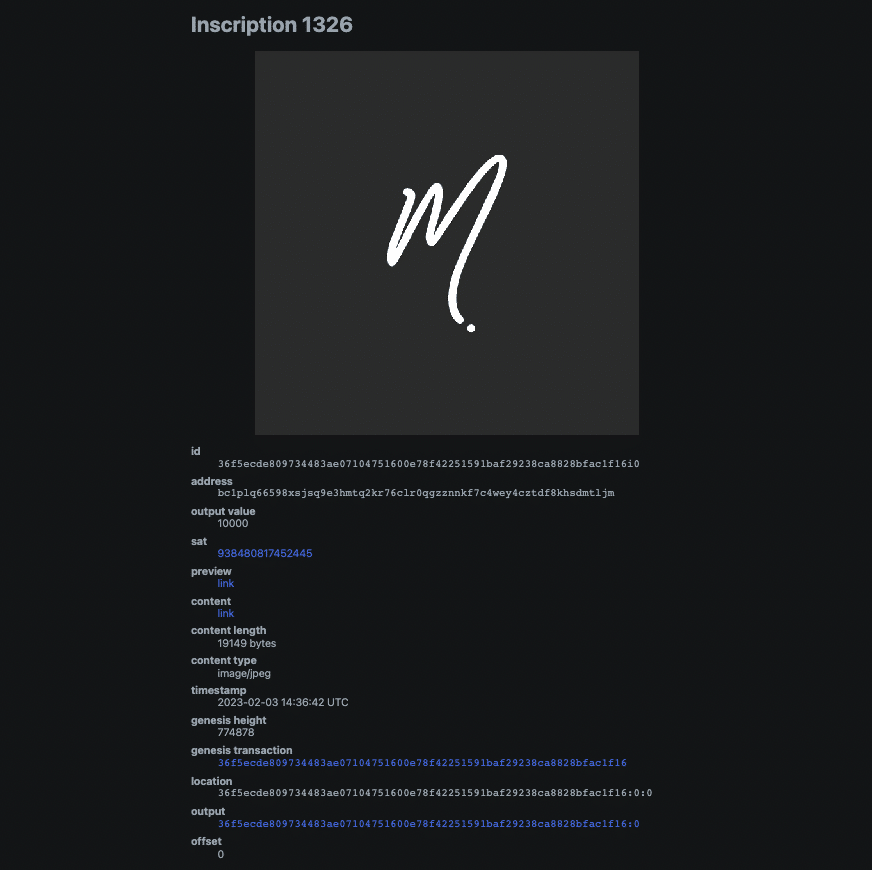

The Ordinals protocol allows for content to be added to a Bitcoin transaction that is then assigned to an individual satoshi (smaller denominations of bitcoins), each with its own unique serial number. The process of assigning content on Bitcoin to a satoshi is known as an “inscription”.

These satoshis that contain inscriptions can then be transferred to other wallets, in a similar fashion to NFTs on Ethereum.

Unlike Ethereum, where the content linked to from an NFT (e.g. digital artwork) is hosted off-chain within platforms like IPFS or Arweave, Ordinals hosts this content directly on the Bitcoin blockchain. In fact, the entire process is managed end-to-end within the Bitcoin blockchain without the need for new tokens or sidechains.

Since its launch, several thousand inscriptions have been created. Each one has its own serial number, starting at 0 and increasing by 1 chronologically based on the time it was mined on the Bitcoin blockchain.

Here’s inscription #1,326 that I created (with the generous help of Niski):

Projects have been racing to create early numbered inscriptions as it seems that these could be valued with greater provenance. Time will tell if that’s the case, though.

Some of the earlier “collections” to be launched include Bitcoin Rocks, a derivative of the popular Ether Rocks project, and Ordinal Punks, paying homage to CryptoPunks.

What’s somewhat crazy right now is that there’s currently no marketplace to buy, sell, and swap Bitcoin NFTs. It’s all being done via over-the-counter (OTC) trades within Discord groups. This is going to change very soon, but if you’re planning on trading, please be vigilant because it’s an environment ripe for scams.

Ethereum NFTs vs Bitcoin NFTs

Bitcoin NFTs are technically very different to those created on Ethereum (and other smart contract-enabled blockchains).

On-Chain Content

The first and most obvious distinction is that Bitcoin NFTs have their content (images, videos, audio, etc.) hosted directly on the Bitcoin blockchain, whereas Ethereum NFTs are hosted off-chain.

As Bitcoin blocks have a maximum storage size of 4MB, this is the maximum file size that can be stored. Due to the content being added directly to Bitcoin, it’s immutable by default, meaning it can never be modified. This isn’t the case on Ethereum as smart contracts can be programmed to modify content in the future, for example, they can be upgraded or burned. Equally, if IPFS or any other platform where the Ethereum NFT’s content is hosted is taken down, the content can be lost.

There have already been some interesting content formats added to Bitcoin in the past few days, including this playable version of the classic video game, Doom.

No New Tokens Required

On Ethereum, there are a number of unique token standards, like ERC-721 or ERC-1155, that are designed specifically to support NFTs (and a range of other use cases). Ordinals simply leverage existing tokens, Satoshis, adding inscriptions to them that reference the associated content on Bitcoin.

On Ethereum, the parameters and attributes of an NFT are coded into a smart contract. This contains information like the size of the NFT collection, the mint price, plus much more. With Bitcoin NFTs it’s much simpler. There are no smart contracts. Instead, all of the necessary information is added to the satoshi via an inscription.

Blockchain-Level Serial Numbers and Rarity

NFTs on Ethereum are typically grouped into collections, each with its own unique token ID that corresponds to its place in the total collection size. For example, BAYC #3258 is token 3258/10000 as Bored Ape Yacht Club has a total collection size of 10,000.

Similarly, the rarity of an NFT is determined by its provenance within the collection that it belongs. This is usually calculated through the uniqueness of its traits. For example, the artwork on BAYC 3258 contains a black hat with the words “BAYC”. This trait is only present in 2% of Bored Apes, which gives it a certain level of rarity within the collection.

Ordinals work differently. There isn’t really a concept of “collections”. Instead, as a new inscription is added to a satoshi, it receives a serial number. These are ordered chronologically based on the moment in time that they were mined. For example, the very first inscription has the serial number 0, the next is 1, then 2, etc.

This all happens at the blockchain level instead of being siloed within a collection.

Similarly, rarity is prescribed at the blockchain level, but this is where it gets even more interesting. Rarity is attributed to satoshis regardless of whether they have an inscription or not. There are a few different variables that impact the rarity of the satoshi but they all relate to the time at which they are first mined. Here are the different rarity types:

- common: Any sat that is not the first sat of its block

- uncommon: The first sat of each block

- rare: The first sat of each difficulty adjustment period

- epic: The first sat of each halving epoch

- legendary: The first sat of each cycle

- mythic: The first sat of the genesis block

The first satoshi that was mined after the last halving epoch would give it an “epic” rarity. If someone were to obtain this satoshi (who knows, this could be sitting in your Bitcoin wallet right now!) and then inscribed sought-after artwork within it, it would no doubt be seen as a particularly valuable sat.

It’s well worth reading more about Ordinals Theory to better understand this. I imagine there will be plenty of tools built out to identify these rarer satoshis so that they can be inscribed.

Accessibility

Creating a Bitcoin NFT via Ordinals requires significant technical knowledge right now. You need to run a Bitcoin node and know how to utilize the ord Github repository as a starting point.

Not only that, but a regular Bitcoin wallet doesn’t support the storing and sending of satoshis with inscriptions. You’ll need to use the Ordinals wallet to do this. There isn’t even a marketplace for the trustless buying and selling of inscriptions yet.

This will change very soon. Ordinals’ answer to OpenSea will no doubt appear, along with a flurry of competitors, while several projects are building more user-friendly wallet solutions.

Until then, the technical barriers to entry for the average user are very high.

Why are Bitcoin NFTs so Controversial?

A large and loud percentage of the Bitcoin community has been very against Ordinals and Bitcoin NFTs as a whole.

The primary argument is that it’s counterproductive to Bitcoin’s core mission, which is to be a better form of money. This has been a long-debated topic, often backed up by the comments made by Satoshi, the creator of Bitcoin, back in 2010 where they said that Bitcoin shouldn’t be used for non-financial use cases.

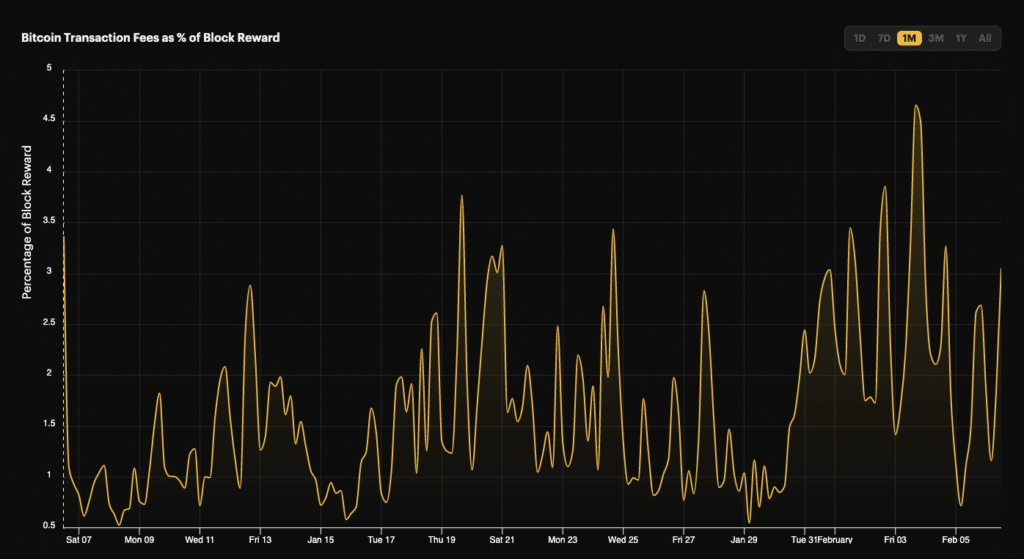

Many from the early Bitcoin community have labelled Ordinals as an “attack” on the network. This is because the large transaction sizes – as a result of the content being inscribed within them – result in much larger block sizes and transaction fees for other users.

In fact, the average block size on Bitcoin hit an all-time high (1.75MB) on February 4th due to Ordinals. The counter-argument here is that this has dramatically grown revenue for miners, who are essential for securing the network. As rewards on Bitcoin reduce (halving every four years), fees become a much more important contributor to total revenue.

Another argument being put forward in favor of Ordinals is that it could serve as a valuable tool for onboarding new users and growing interest in Bitcoin. At the same time, there’s something to be said for having a narrow financial use case for an asset that’s being used as a store of value. Gold is a great example of this where only a very small percentage of what gold is utilized for involves physical production.

Ultimately, the decentralized nature of Bitcoin allows anyone to use the network in a way that fits within the parameters of its design. The only thing that can hinder the growth in projects like Ordinals is a lack of end-user demand.

Will Bitcoin NFTs become a core part of the blockchain’s long-term utility? I’m unsure. Is there a lot of excitement and innovation happening in this space right now? Absolutely.